Regional gaming authorities in New South Wales and Victoria have given their clearance for SS Silver, a corporation owned by funds managed or advised by private equity giant Blackstone, to proceed with its proposed takeover of Crown Resorts.

Blackstone was granted permission to operate a land-based casino in both Victoria and New South Wales by the respective gambling and casino control commissions, which also gave their stamp of approval to the merger.

Initially, in 2021, Blackstone offered £4.63bn, €5.33bn, or $8.02bn to acquire Crown. Although the Crown board turned down this first offer, they did approve an enhanced offer of $8.87 billion.

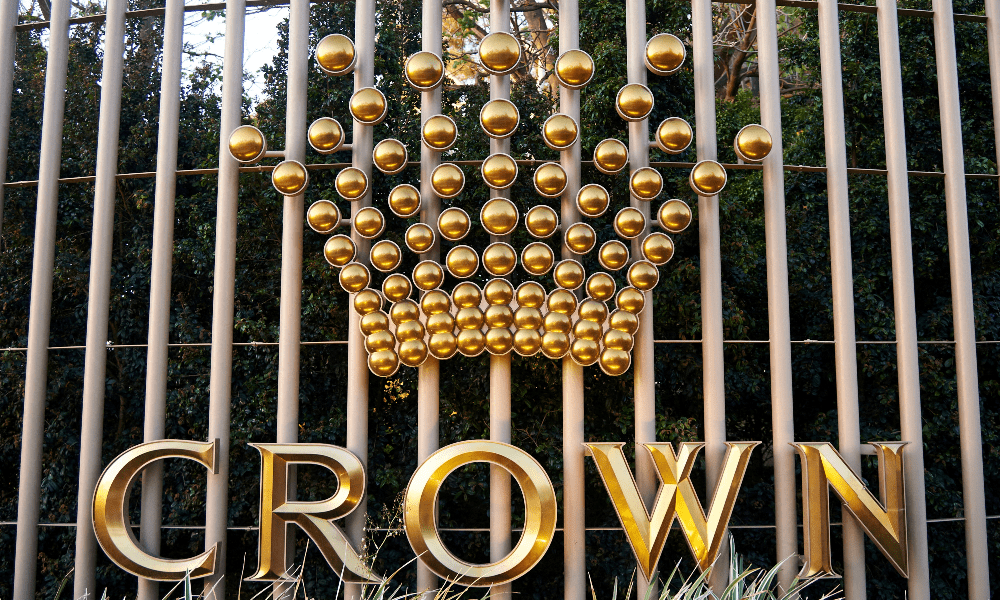

Crown was inundated with enquiries when the offer was made. An investigation found evidence of money laundering at Crown's facilities, rendering them unable to operate a casino in Barangaroo, Sydney, in February 2021.

Crown was also found unfit to run a casino in Victoria later that year after an inquiry found that the company had participated in "illegal, dishonest, unethical and exploitative" behaviour.

Also, the Perth Casino Royal Commission decided not to suggest revoking Crown's licence but rather offered a number of remedies for the operator in February of this year after finding it "unsuitable" to run its Crown Perth facility in Western Australia.

Blackstone has not yet received the necessary approval from the Perth regulator to finalise the acquisition of Crown. Consequently, the completion date of the takeover is uncertain.

Crown Resorts's shareholders approved the acquisition last month. With 99.91% of votes cast in support of the transaction, 92.05% of shareholders who were present and voting were in favour of the acquisition.

The chairperson of the NSW ILGA, Philip Crawford, commented on the decision to approve Blackstone's takeover proposal and to operate the Crown Sydney site, saying that Blackstone had to undergo a thorough probity assessment that looked at how well it could handle the problems and risks highlighted in the Bergin Report.

Crawford clarified that "some individuals have been authorised to become 'close associates' of Crown Sydney" as a consequence of the probity evaluation. In order for Crown Sydney to fulfil its commitments for significant operational, governance, and structural improvements, the Authority is continuously working to secure these approvals.

"Blackstone, as the potential owner of Crown Resorts, has to show that it is committed to the whole suite of operational adjustments suggested by the Bergin Inquiry and that it has the highest standards of integrity.

"This pledge is critical to safeguard Crown Sydney from criminal influence and effectively manage the hazards connected with gaming."

Blackstone and Crown were required to consent to a long number of stipulations and safeguards, as explained by VGCCC chairperson Fran Thorn, who also detailed the regulator's decision to approve.

Improved reporting of anti-money laundering and responsible gambling activities, new role requirements for Crown Melbourne's CEO and key executives, and non-interference requirements were among these measures. Crown's governance was also strengthened through the mandatory application of the ASX Corporate Governance Principles and recommendations.

In addition, Blackstone was obligated to invest in and retain Crown Melbourne as its flagship casino in Australia, increase information exchange with law enforcement agencies, and not change its corporate structure or financial arrangements without VGCCC permission.

These will be on top of the several conditions that Crown Melbourne was already under to after last year's probe. Other measures still to come include having to work under a special manager who has been appointed and having the VGCCC's suitability review in 2024 for licence renewal.

When asked about the decision, Thorn explained that it was the result of months of research into whether the Blackstone Group was a good fit to join up with the Melbourne casino operator.

We have placed strict conditions on our license to ensure that the casino remains the flagship in Australia while also delivering greater regulations. If Blackstone or Crown fails to meet any of these standards, we will take appropriate action.

This ruling followed last week's AU$80.0m penalties that Crown received from the VGCCC for transactions involving China Union Pay (CUP) cards. According to the VGCCC, it was unlawful for the Crown Melbourne casino to accept CUP credit or debit cards as a means of gambling between 2012 and 2016. The operator made over $32 million via this practice.