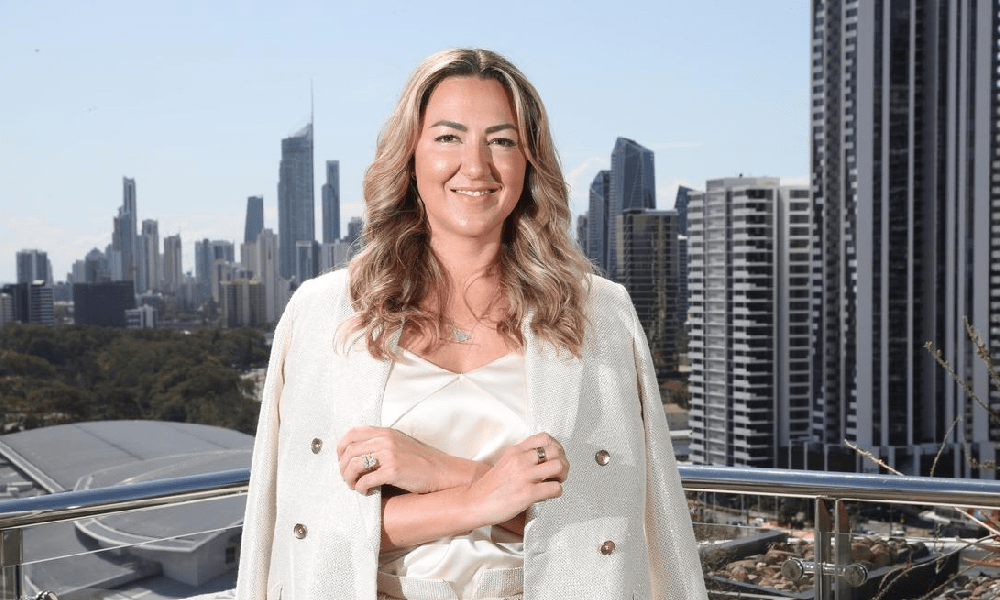

Star Entertainment Group of Australia has promoted Jessica Mellor to the position of chief executive officer for its Gold Coast operations.

Former Star Gold Coast COO Mellor is now the CEO of Star Gold Coast, an appointment that is pending specific regulatory clearances. She had been in her current position since July 2019, and she had previously worked as the property's general manager.

After holding executive positions at Aquis Australia and Aquis Entertainment, Mellor joined Star. She has also worked for Leighton Contractors, the JLF Group of Companies, and Custodian Funds Management Group.

"I was so grateful to be able to return to my hometown and take on an amazing opportunity when I joined The Star in 2019," Mellor said. "This is a whole new ballgame with this new role.

Over the past four years, we've faced some challenging moments, like the epidemic and the constant need to adapt. However, our city has an incredible future because the Gold Coast is inventive, resilient, and forward-thinking. When it comes to that, the Star can make a huge impact.

Regional management at Star is reorganised.

The appointment is a part of a larger organisational reorganisation that would establish operational business units based on property. Brisbane, the Gold Coast, and Sydney will all be covered by these Star sites.

A chief executive officer (CEO) stationed at each site will report to Robbie Cooke, the group's CEO and managing director. Additional details about the appointment of CEOs in Brisbane and Sydney will be announced by Star at a later date.

"Jess and the Gold Coast team have delivered a world-class tourism, entertainment and gaming destination over the past four years, through some incredibly challenging times," says Group CEO Cooke.

We are streamlining our structure and establishing clearer operational accountability at each of our Gold Coast, Brisbane, and Sydney sites through these organisational reforms. The new system will allow for more autonomy and responsibility at the property level with the right amount of supervision from the group level.

Deductions from casino value impact annual financials

As Star continues to tally the cost of a writedown in the value of its Sydney, Gold Coast, and Brisbane casinos, the appointment and restructure take place. Overall, it resulted in a AU$2.40bn (£1.25bn/€1.45bn/US$1.53bn) net loss for the year.

Spending of almost $2.8 billion was classified as "significant items" for the fiscal year ending 30 June 2023. This came after a series of penalties and fines in the past few years.

This included a non-cash impairment of goodwill and property assets valued at AU$2.20 billion for the Sydney, Gold Coast, and Treasury Brisbane locations. Redundancy cost AU$16 million, regulatory and legal costs AU$595 million, and debt restructuring cost AU$54 million.

Following the announcement of a massive capital reorganisation last month, Star also temporarily suspended trading on the Australian Stock Exchange. The AU$750.0m capital raise was the central event.

Star has also inked fresh $450.0m in financing facilities with Westpac Banking Corporation and Barclays Bank. This consists of a $300.0 million underwritten term loan and a $150.0 million revolving credit facility, both with terms of four years.