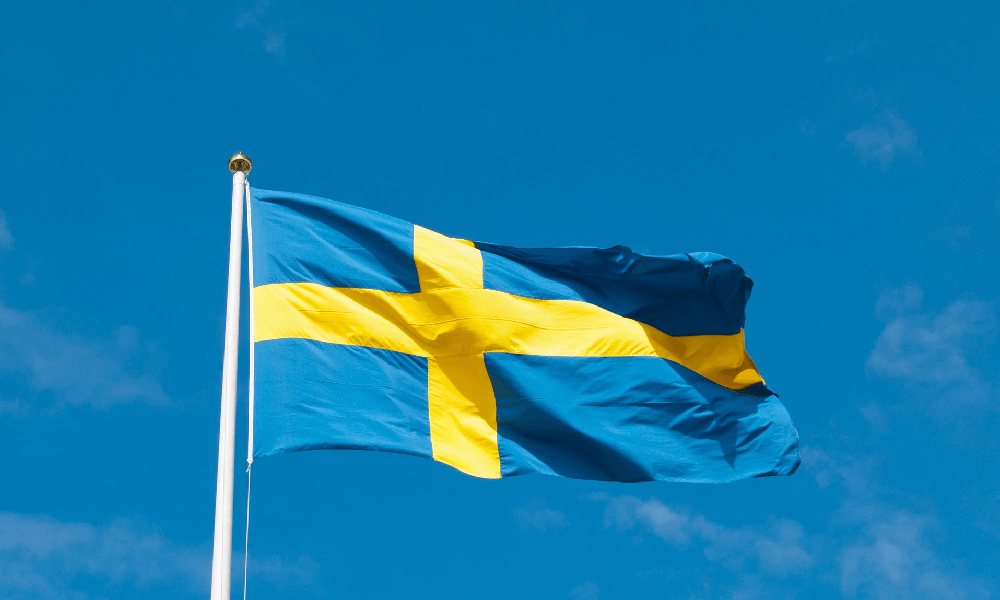

Hasse Lord Skarplöth, CEO of Aktiebolaget Trav och Galopp (ATG), has demanded a differentiated tax system in reaction to the government's announcement of plans to double the gaming tax.

AT&T Sweden

The Swedish government (Regeringen) announced in September that it will increase the country's gambling tax rate from 18% to 22% of gross gaming revenue (GGR). The tax increase, if passed, will take effect in Sweden on July 1, 2024.

The industry, especially the ATG, strongly opposed the plans, even though Regeringen believes they might result in an extra SEK540.0m (£39.3m/€45.5m/$48.4m) in tax revenue annually.

According to Skarplöth's blog, Regeringen's ideas are a "shock." He argues that taxes on igaming should be increased but taxes on horse and other sports betting should stay stagnant. As an argument for the Regeringen to reconsider its plans, Skarplöth pointed to other European nations that have implemented differentiated gaming taxes.

The idea for a greater excise tax on gaming enterprises was shocking, according to Skarplöth. The subsequent response was one of resignation; with ATG's contribution drastically cut, how could the already struggling horse industry cope?

"The desire to fight quickly returned; is there a way forward that replenishes the coffers without endangering equestrian competition?"

Building on our previous work, we have recently dedicated a great deal of effort to proving the benefits of a differentiated gaming tax in Sweden. Now we're crossing our fingers that lawmakers will take action based on our findings.

"Our proposal is well-grounded in this idea; we propose maintaining the tax on sports and horse betting while increasing it on online casinos."

Swedish gaming ring ATG has vowed to crack down on illicit gambling.

Following its pledge to fight down on unlawful gambling in Sweden, the state-owned betting industry, the ATG, has proposed a differentiated tax.

Swedish channelling Since 2019, the number of illegal gaming sites in Sweden has increased tenfold, according to ATG research.

The ATG reported in November that, since the beginning of legal betting in Sweden in 2019, the number of visitors to illegal websites has increased tenfold.

According to ATG data, the percentage of regulated online gambling that was channelised in Q3 2023 ranged from 70% to 82%. The channelisation rate for online casinos was 74%, compared to 88% for online sports betting.

The illicit market is worth an estimated SEK3.4–6.7 billion per year, according to ATG. A total of 60% of the illicit gaming visitor traffic in Q3 was attributed to two groups, Infiniza Limited and North Point Management Ltd, according to the ATG.

The ATG would do all it can to address the issue going ahead, Skarplöth declared after voicing his concerns over the data.

Skarplöth expressed concern over the results of their quarterly surveys, which show that a large number of problem gamblers in Sweden are associated with unregulated gambling sites.

The Swedish market continues to be a stronghold for ATG, with GGR from Swedish licence-holders remaining stable at SEK6.7bn in Q3, unchanged from the previous quarter. The land-based casinos saw the biggest rise in turnover, with a 30.5% year-on-year growth.

Results from ATG H1

The operating profit of the atg increased by double digits year over year in the third quarter of 2023.

In the meantime, the three months leading up to 30 September 2023 were incredibly profitable for the ATG, as their operating profit increased by double digits.

From SEK1.29bn in the previous year, net gaming revenue increased 4.5% to SEK1.35bn. The third quarter achieved the second-highest total for ATG, even though the Swedish market was stagnant in the first half.

There was a 3.0% year-on-year increase in total revenue to SEK1.53bn for the three months. Revenue from operations increased 13.7% year over year to SEK497m for the group.