Despite a decline in revenue, social game company Playtika reported an increase in net profit for the second quarter compared to the same period last year.

The Playtika platform

There were ups and downs for Playtika over the six months ending 30 June. Social media income fell in the second quarter, and the number of users paying each day fell as well.

Even though revenue fell throughout the quarter, Playtika increased its net profit because to expense reductions.

The developer has stated that it is still in a strong financial position and is thus open to mergers and acquisitions. Playtika and Azerion reached an agreement shortly after the quarter's conclusion to buy Youda Games' content portfolio, which includes the Governor of Poker title.

It was early on that Playtika responded to the evolving mobile gaming environment, according to Craig Abrahams, president and CFO of Playtika. Therefore, we can confidently seek out merger and acquisition opportunities, such as Governor of Poker, to strengthen our portfolio's growth profile.

Our knowledgeable live operations staff and strong relationships with our players continue to be a strength for us. We are still dedicated to driving payer conversion through the use of our technical solutions and well-known brands.

Q2 revenue for Playtika's social casinos was $642.8m (£506.6m/€587.6m), a 2.5% year-on-year decline.

Though it did release some numbers, Playtika did not reveal all of its financial success. Revenue from social casino games fell 9.9 percent, while that from casual games increased 3.7 percent and that from Blitz Bingo 6.3 percent.

At 307,000, the average number of paying customers per day fell 1.0%. The average payer conversion, on the other hand, increased by 3.2% year over year.

Profits rise as expenses fall

Spending cuts more than compensated for revenue cuts. With reductions in spending across research and development, sales and marketing, and general administrative, operating costs fell 11.4% to $503.6m.

Positive interest of $23.1 million also helped Playtika. Profit before taxes increased by 68.5% to $116.1 million. The developer's net profit was $75.7m, an increase of 108.0%, after deducting $40.4m in taxes.

Alteration to the fair value of derivatives amounted to $14.8 million, and the developer deducted $200,000 for translation of foreign currency. Accordingly, at $90.3m, comprehensive net profit was $340.5% more.

Furthermore, the quarter's adjusted EBITDA jumped 6.7 percent to $215.0 million.

Similar narrative in Playtika's H1 page

The first half, which includes the six months ending 30 June, followed a comparable trend. While expenses fell 10.4 percent to $1.01 billion, revenue fell 2.8 percent to $1.30 billion.

With $51.7 million in positive interest, Playtika's pre-tax earnings increased to $239.9 million, a 48.3 percent increase. The developer's net profit increased by 33.6% to $159.8 million after paying $80.1 million in taxes.

It was greater after factoring in $2.9 million for favourable translation of foreign currencies and $7.0 million for fair value of derivatives. The overall net profit was $169.7 million, an increase of 41.9%. The adjusted EBITDA also increased by 9.7 percent to $437.7 million.

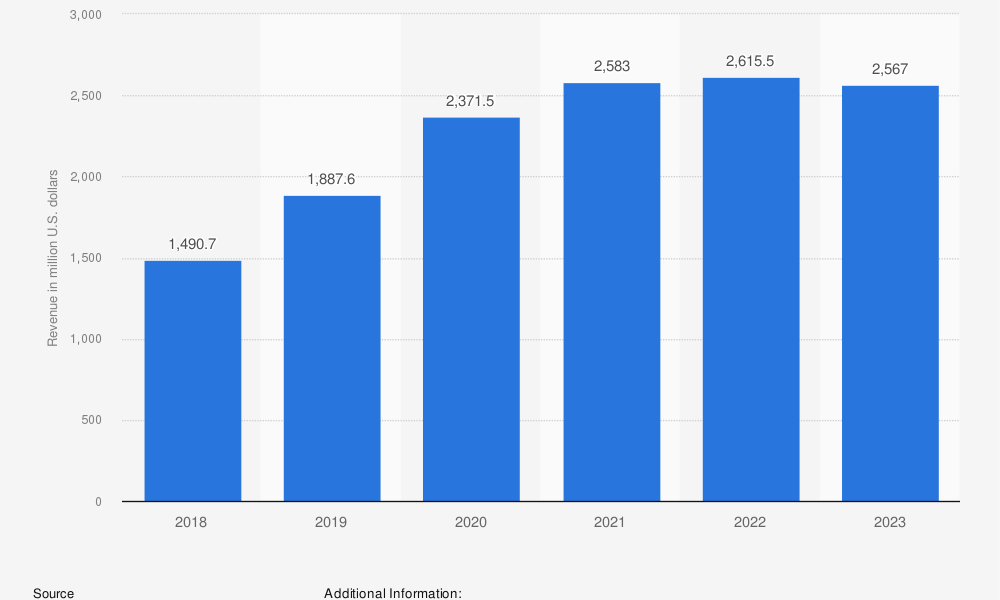

Conflicting annual forecasts

The rest of the year will be affected in the similar way, according to Playtika's guidelines. According to Playtika, revenue could fall somewhere between $2.57 billion and $2.62 billion.

This amounts to between $805.0 million to $830.0 million in adjusted EBITDA. Capital expenditures, according to the developer, would be between $100.0 and $105.0 million, down from an earlier estimate of $115.0 to $120.0 million.

"Our operational expertise and advanced technological capabilities are drivers of our strong profitability and robust cash flow generation," Playtika CEO Robert Antokol stated.

The full potential of our titles is unleashed and the value of acquired assets, like the Governor of Poker franchise deal, may be enhanced by coupling our human skills with our proprietary technology.

The evolving approach of Playtika

These outcomes are the consequence of several efforts made by Playtika to reduce expenses.

Near the year's end, the business revealed intentions to lay off 600 workers, or about 15% of its workforce. As part of its "non-core products" phase-out, the company explained this.

Until the return on investment (ROI) for new games becomes "economically viable," Playtika will cease new game development, as it affirmed in March.